A Quarter for your thoughts

Reflections on 4 months into my Stanford MBA

I applied for my MBA in September 2024 on a whim, partly to use my GRE score before it expired, and partly to be in the US during the 2026 FIFA World Cup. Against my wildest dreams, I got into Harvard and Stanford. Damn, I remember thinking, I guess I’m now obliged to uproot myself and depart to the Land of the Free.

In this post, I want to peel back the layers of mystique and provide you a candid look into life at the Stanford Graduate School of Business: why I’ve spent the last four months pedaling between billionaire guest lectures and free food events, and how it’s changing me despite my stubborn skepticism.

“It’s just a bridge,” I thought, but damn is the Golden Gate impressive!

The months before I flew to San Francisco were spent feverishly seeking advice from GSB/HBS alumni, distilling their wisdom into a spreadsheets. The main threads were: be intentional about your time because it flies by; those who made the most of the MBA knew at a niche level what they wanted to get out of it and executed relentlessly. Simultaneously, be open to experimentation and serendipity. Spend quality time with my classmates. Milk the stanford.edu email address for everything it’s worth to network the hell out of Silicon Valley. Get comfortable with credit card debt and go for those expensive lunches (*gulp*). Most importantly, act in a way that your 50-year old self would be proud of looking back. “Work for your obituary, not your resume. Don’t think incrementally. Think of something completely out of your reach and Stanford will make it possible for you and launch you into a different orbit.”

I do want to call out all the GSB alumni, India and globally, who were incredibly thoughtful and generous with their time for us new admits. Such a warm, special and tight-knit community to be a part of! We had GSB and Stanford send-off events in Delhi, Bangalore and Mumbai hosted by alumni at their homes. Even on a short trip to London, I was able to catch up with three GSBers working in sustainability.

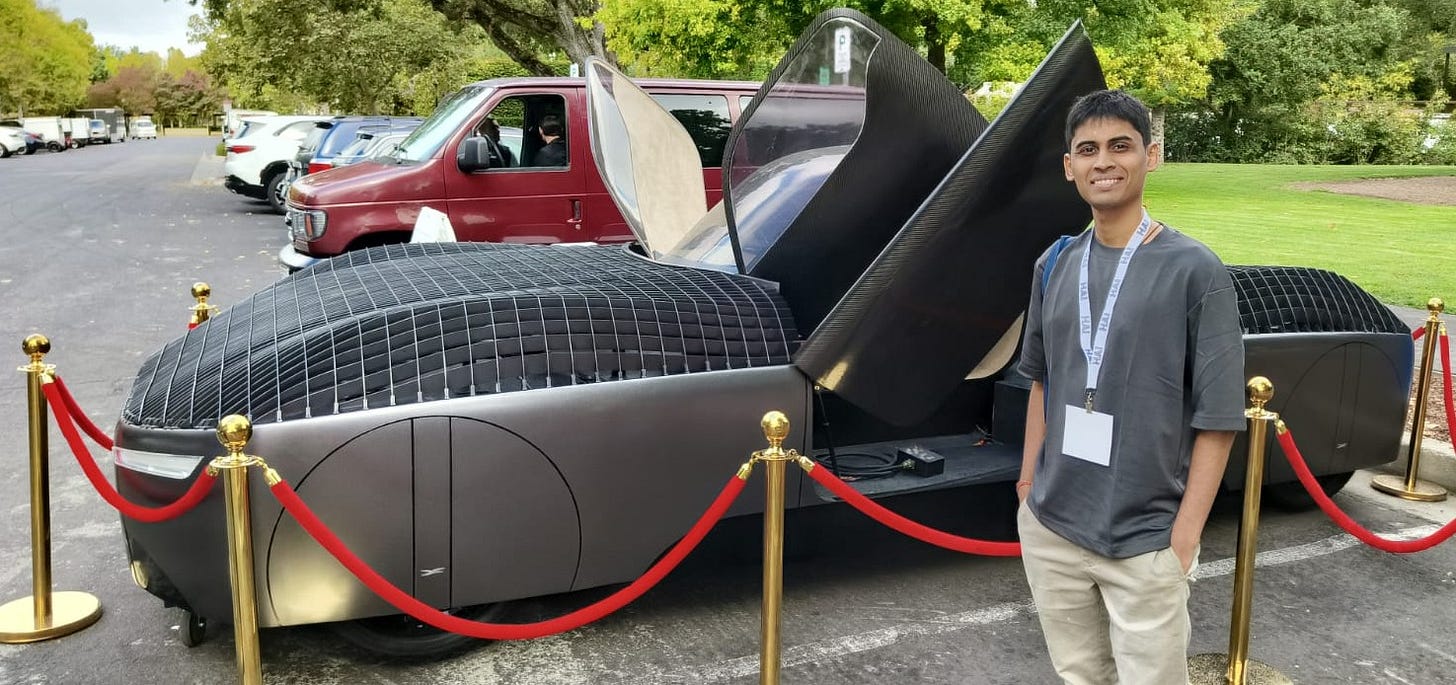

First Impressions - Flying Cars, Analog Brains

On my very first day at Stanford, I stumbled upon a flying car and attended The Next Revolution of AI Impact Summit. The man sitting next to me got a call-out from the moderator as the designer behind the Apple Vision Pro. Some welcome to the Farm.

VC gurus from my LinkedIn newsfeed were milling about with boxed lunches, wearing turtlenecks and Patagonia vests, just like in the Social Network. The day started with a video address by Reid Hoffman, who argued we are entering an era of massive economic surplus, similar to the "free" value created by Google Search. Reid sees AI as a "factory" for drug discovery, potentially compressing decades of medical research into months.

I was thrilled to hear Steve Jurvetson (Co-Founder of Future Ventures and early backer of Elon Musk) pontificate with all the Silicon Valley techno-utopianism of my dreams. Steve argued that the "baton" of Moore’s Law is being handed off; the future is 'analog-adjacent' architecture that mimics the 3D connectivity of the human brain

If you follow the historical curve of Moore’s Law, the arrival of AGI isn’t a “if,” it’s a “when.” Consider that biological evolution is never finished. It is anthropocentric to think humans are the "end point" of evolution. AI evolution follows the same trajectory. We are moving toward a world where the distinction between biological evolution and technological iteration is dissolving.

The primary challenge today is the cost of huge prompt context windows. Eventually, the cost will drop enough to allow for infinite context. Imagine a prompt like: “Synthesize every news report from every source on Topic X since the beginning of time.” That level of data ingestion will unlock a “magical” shift in how we process human knowledge.

Innovation is rarely a “bolt from the blue.” Like Edison, Tesla, and Marconi arriving at similar breakthroughs simultaneously, AI is now the ultimate engine for the recombination of existing ideas.

The Data Flywheel is the core thesis behind Steve’s investment in x.AI. Success in AI will be dictated by who can create the most efficient loop between data generation and model improvement. That, and “you never bet against Elon.”

I then heard from Waymo’s Drago Anguelov, VP and Head of AI Foundations Team. Drago shared that the journey to autonomous driving has been long (30 years since the first transcontinental autonomous drive) but the “LLM wave” is providing a second wind. At Waymo’s scale, success is defined by the “long tail” of rare, difficult scenarios. To solve these, you cannot program for every event; you must generalize. Waymo is using large-scale models in data centers to supervise and train the vehicle’s onboard “driver.”

Roger Federer playing charity matches at Stanford’s tennis court. Rishi Sunak and Tiger Woods were also on campus in my first few weeks.

Disneyland for Nerds

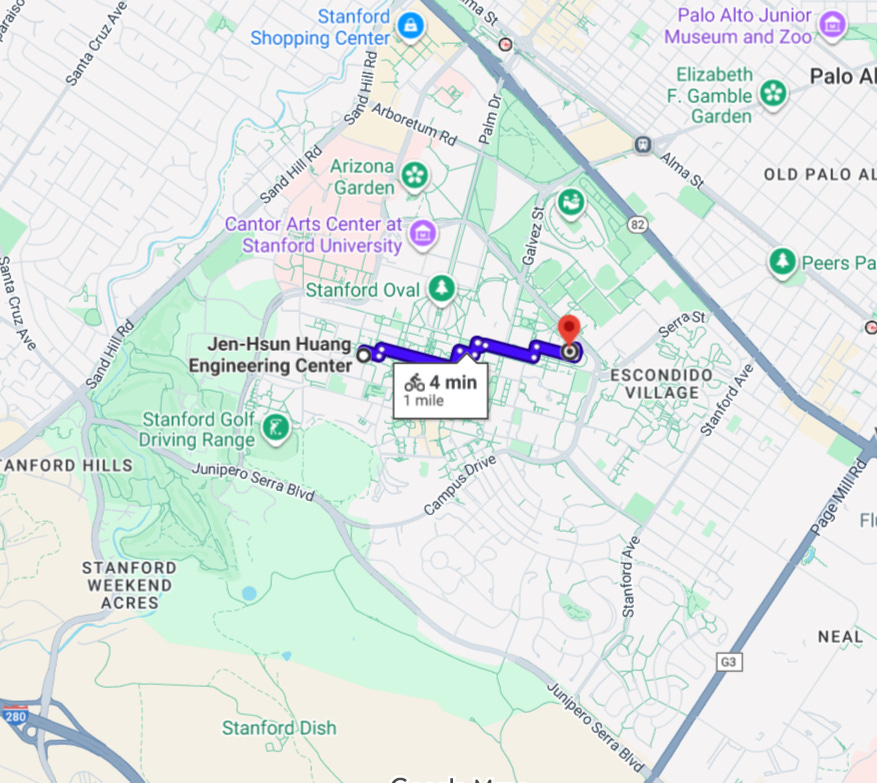

Once I bought a second-hand rust bucket bicycle, I realized the beauty of the GSB: winding bike paths and consistently perfect weather means I have all of Stanford at my fingertips. Within seven minutes, I can get from the GSB to the Engineering Quad for a coffee chat with a PhD student, or to Tressider Union to meet an undergrad. Stanford is geographically massive, with its own zip-code, but its selectivity ensures the humans-to-acres ratio is relatively low. The GSB itself, for instance, is ~430 students; large enough for diversity, but not to the point of anonymity. I encounter enough of the same faces at events and around campus that relationships compound.

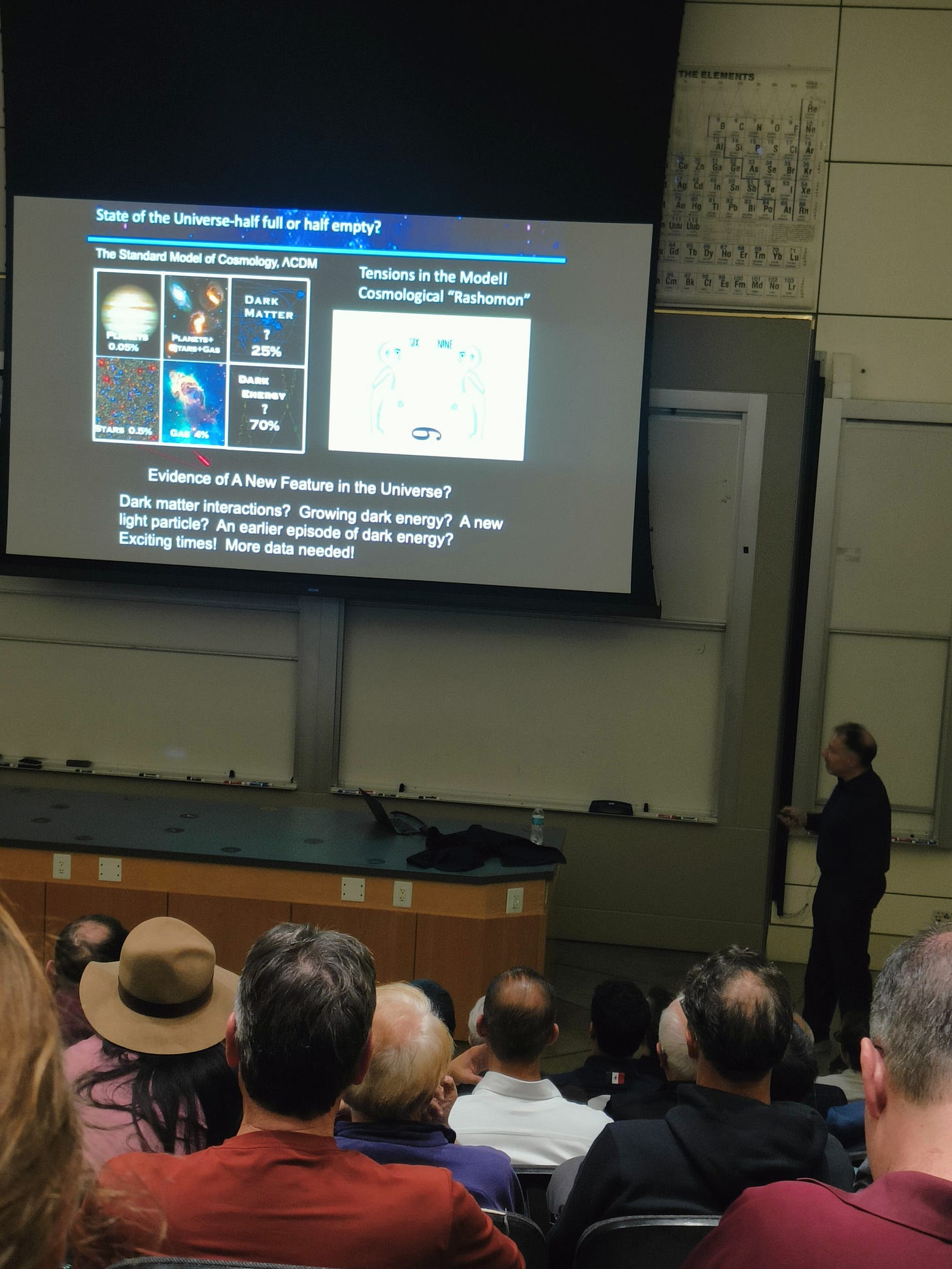

I soon became a biking junkie, pedaling furiously from a coffee chat with a GSB classmate about life and relationships, to listen to a Nobel laureate…

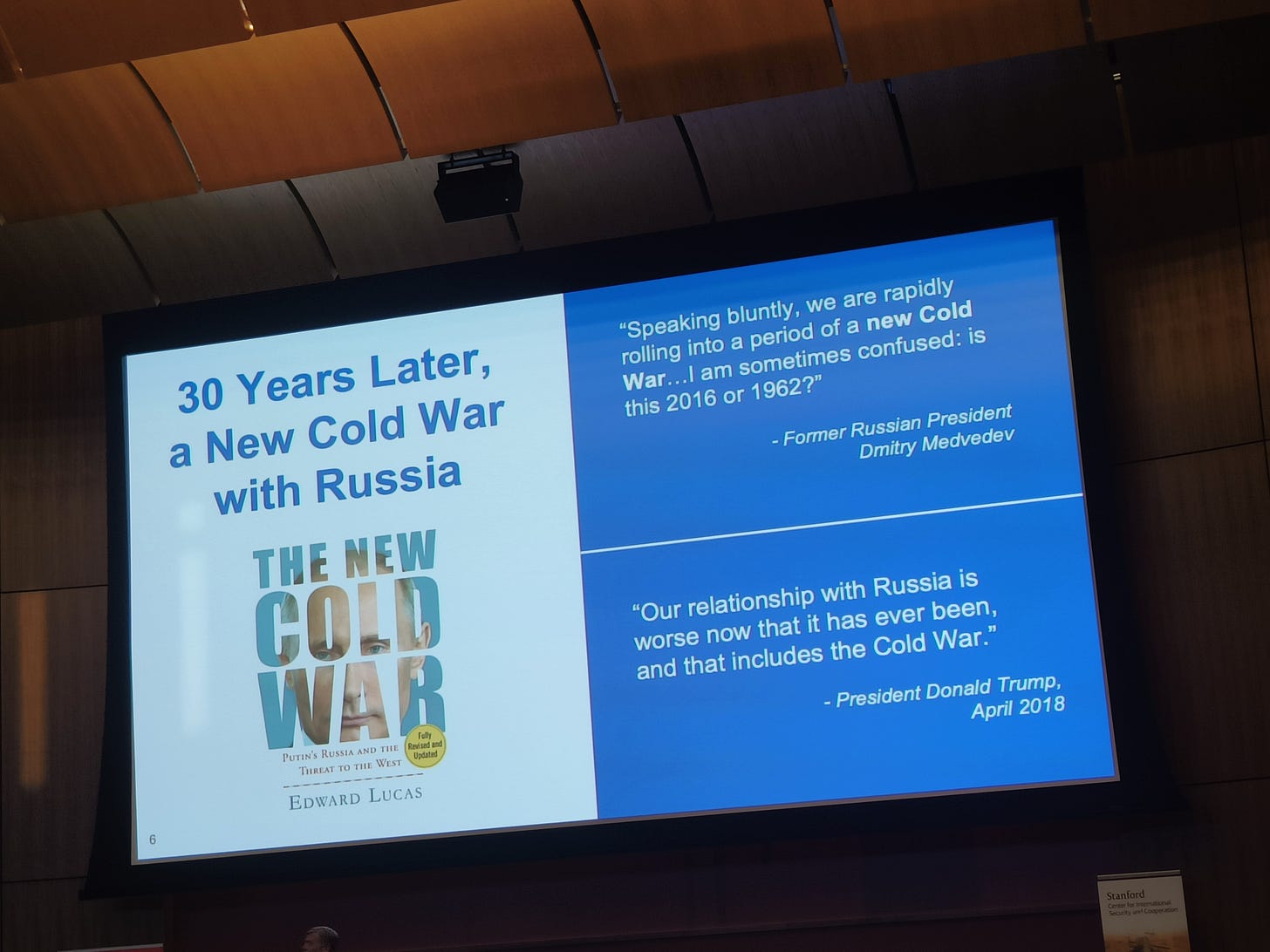

…or to attend a geopolitics talk at the Hoover Center.

I found my tribe in Stanford’s "Free Food" WhatsApp groups, spamming them with coordinates of stale sandwiches. I’ve been particularly blown away by the undergrads: first-years here already feel like they’re falling behind if they aren’t working on a startup. I’m lowkey glad my undergrad experience at NYU Abu Dhabi wasn’t such an AI-powered pressure cooker.

Academics and the P&Q Debate

You may have seen the Poets & Quants ‘We are not learning anything’ article about the GSB. My take is that it’s partially true when it comes to the core curriculum. Leading with Values, the GSB’s ethics course, was gallingly shallow given Stanford’s top-notch philosophy department. Optimization and Simulation taught archaic Excel features. Finance was decent and my Accounting professor was outstanding. The GSB lets you take core courses at the Base, Accelerated, and Advanced levels, so that you don’t have tech/finance folks skewing the curves.

Lead Labs was a highlight. Every week, my "Squad" of 6 students was led by an MBA2 Arbuckle Fellow to do role-plays. I used this to practice being more assertive and not backing down in negotiations, as I often do. It culminated in the Executive Challenge, a GSB tradition where we role-play with alumni. Lead Labs helped me introspect on the leadership qualities I admire/grudgingly respect in my past Managers, and how leadership isn’t necessarily intrinsic but can be learned through practice of specific behaviors.

I’m hoping that the flexibility in curriculum from the second Quarter onwards makes up for the sub-par experience thus far. I formed a team of undergrads and Master’s students to take Innovation for Climate, a project-based course. I’ll be in Ecopreneurship Foundations, a course on impact measurement with Matt Bannick, and a class with Nobel laureate Susan Athey, among other goodies.

Bender Room in Green Library. Coming from Gurgaon/Mumbai’s heat and pollution, I’ve loved exploring different study spots and spending so much time outdoors under the California sun. I’ve also stocked my room with all the hardcovers of Showa and Akira volumes I could never justify buying.

Something I struggled with was studying less. GSB is packed with high school toppers for whom slacking off is harder than slogging. But with grades curved, getting a "High Pass" feels like a failure of prioritization. Parkinson’s Law is true: work expands to fill up time. I need to be more disciplined about going after the unstructured stuff without clear, short-term outcomes.

Most of the real learning at the GSB is the meta-learning. I really resonate with this blog by two GSBers: “The real work of business school, then, is not to hand you another “how,” but rather to train the muscle of “why,” the sensitivity to the problems worth solving, and the people worth betting on.”

The AI Tsunami

A major reason I bet on attending the GSB to plant myself in the AI tsunami sweeping through the Bay Area. I expected everything to revolve around GenAI, and indeed, practically every pitch at Lean Launchpad was a GenAI idea. Everyone is building "GenAI for automating workflows in [insert industry]." However, I’ve observed growing skepticism. A leading VC I had dinner with said he refuses to invest in AI startups right now, though it's hard to find anything else to invest in. Stanford CS Master’s/PhD’s roll their eyes at the AGI spiel because its killing other research topics/AI models. I’m on a GSB WhatsApp group specifically for discussing the bear case for GenAI.

CS undergrads told me: “Nobody wants to be a coder anymore. We CS kids are thinking what else we should major in. More students are interested in quant research, AI research, or even management consulting. Core classes at Stanford force us not to use AI but the more advanced programming courses are all increasingly using LLMs.”

The GSB curriculum is going through teething pains to adapt to GenAI: last year they allowed unrestricted use of AI and this year they're not allowing us to use it at all in most courses. The GSB launched an “AI at GSB” initiative this Quarter which has been pretty great at bringing in tech folks to run AI tool workshops: for example, on how to get smart on any market / build a business plan by using LLM research prompts. Here are three talks on AI which stuck with me:

I attended the fascinating final lecture of CS146S: The Modern Software Developer delivered by Martin Casado, GP at a16z and Cursor board member.1 Martin argued that while AI has been around since decades, the boom is occurring now only because of the economics. Hiring a human graphic artist might cost $100, while a small diffusion model costs $0.0001. Entirely new markets are hence erupting out of nowhere. AI is the “worst computer solution of all time”: inefficient and approximate. But AI has one property that software engineering has never had before: you can throw money at it to make it better. In traditional engineering, doubling the budget doesn’t double the quality of the code; in AI, it often does. The key dilemma in how we will build software development going forward, according to Casado, is Monotheism vs. Polytheism:

Monotheism (The “God Model”): We rely on one all-powerful model (like a future GPT-5 or 6) to do everything. If the model can’t do it today, you “go to the beach” for 18 months and wait for the next update to solve it.

Polytheism (The Assembler): We use multiple different specialized models stitched together with traditional code. This is how tools like Cursor work today, using different models for chat, tab-complete, and background context

When you abdicate logic to a single “God Model” (Monotheism), you lose specificity. Casado used a 3D gaming analogy: if an AI generates a 2D video of a game, you lose the “Z-axis”: you can’t program specific collisions, gravity, or distance because there is no underlying math, just pixels. For now, Martin believes we will inhabit a Polytheistic world. Long-term, who knows.

Stanford CS hosted Jeff Dean, Chief Scientist at Google. Jeff shared that the most challenging obstacle remaining is building models that learn continuously. Today’s models are mostly "frozen" after they are trained. The next frontier is creating AI that, like a human, gets smarter with every single interaction rather than needing a massive "re-training" session. Jeff claimed that we’ve moved from simple "next-word" guessing to actual logical reasoning. By requiring models to "show their work" step-by-step, their accuracy in math and logic improved significantly. A version of Gemini 3 recently solved 5 out of 6 problems in the International Mathematical Olympiad (IMO). This is a "PhD-level" milestone, as these problems are notoriously difficult even for the best human mathematicians.

Our Linear Optimization instructors invited Guillermo Rauch, the (hilarious) CEO of Vercel, for a fireside conversation. Guillermo introduced us to the concept of the “Generative Web.” In the past, developers built an app once, and everyone used the same version. In the future, apps will be ephemeral and just-in-time: they are generated on the fly by AI specifically for your current problem and might disappear once the task is done. So instead of a doctor using a generic medical app, an agent might spontaneously create a custom dashboard just to analyze one specific patient’s case. To the palpable relief of MBAs in the room, Guillermo argued that when anyone can generate code, the most valuable skills are taste and domain expertise. Ending on a personal note, Guillermo shared that he doesn’t believe in “work-life balance” but in “integration”. He vibe codes with his kids rather than keeping them separate from work. Guillermo’s motto is to “lean into the pain”. Playing it safe with “five layers of safety nets” is a recipe for stagnation.

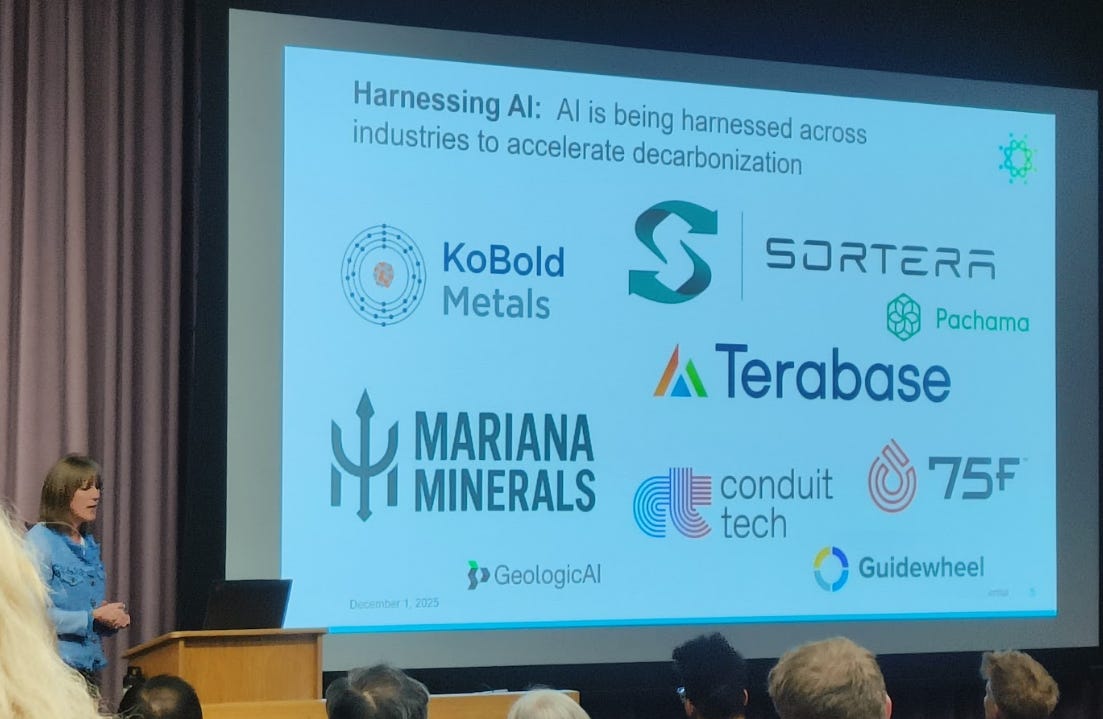

Climate Change: The Techno-optimist’s Version

The primary reason I decided to attend Stanford was the unparalleled climate-tech ecosystem and E-IPER joint degree. I used the Autumn Quarter to network within Stanford’s climate community and map out the individuals, labs, and organizations within campus relevant to my goals.

Sunlight filtering through waving palm fronds. Spanish Revival architecture glowing golden. Plump squirrels suicidally sprinting in front of your bike. One can almost forget that we’re in the middle of the Anthropocene extinction. Stanford is a great place to get delusional about saving the world.

I expected US climate-tech to be on life support. Stanford climate PhD’s are scrambling to find funding. But to my relief, there is a critical mass of professors and students long on climate-tech. Many successful Bay Area executives have found their calling in climate, like Mike Schroepfer, John Doerr, and Bill Gates, and are connected to Stanford. Khosla Ventures, Breakthrough Energy and others have formed the All Aboard Coalition.

There’s a resurgence of interest in grid resilience and renewable energy to meet data center energy demands. Companies like PermitPal, EmeraldAI, and GridCARE have spun out of Stanford. Climate x AI funds are popping up, and climate-SaaS startups like Rimba, Offstream, and Spark have raised from YC. As a Stanford climate enthusiast it’s hard not to be sucked into the climate x AI vortex.

A good deal of Stanford’s climate programming is supported by oil/gas, cement, and steel industries. Many students/professors are interested in decarbonizing hard-to-abate sectors, evident in the projects supported by Stanford’s newly created Sustainability Accelerator. Stanford takes a pragmatist, market-friendly approach to climate-tech (which has not been without controversy). The prevailing ideology here is that climate should be a co-benefit and not the primary selling point. The product/service a climate-tech venture offers has to be better than (not just reach parity) with existing solutions. Conversations around climate policy are limited to it as an enabler for tech solutions.

There’s an ongoing rebranding of climate-tech as ‘national security, energy dominance, resilience.’ During SF Tech Week, GSB classmates and I attended a talk by Zach Dell, CEO of Base Power at the a16z office (coincidentally, just the evening before Base announced their $1Bn fundraise). During Base’s presentation there wasn’t a single mention of sustainability: it was all about powering the AI revolution and ensuring US national security.

Random side-note: The GSB hosted Colossal Biosciences, which is trying to bring mammoths back to life. Mammoth and elephant DNA are 99.6% similar. Introducing large animals in cold climate is apparently beneficial to solving climate change, and Colossal expects to generate revenue through carbon credits. That, or it goes Jurassic Park.

Stanford Climate Ventures

My academic highlight this quarter was auditing ‘Stanford Climate Ventures,’ Stanford’s keystone climate-tech entrepreneurship class taught by Breakthrough Energy Ventures. Autumn Quarter SCV has weekly guest lectures by climate Founders/VCs, so that by the end of the quarter students ‘fall in love’ with a tough problem worth solving. In Winter and Spring Quarters, student teams apply to SCV to practice startup idea validation through the Lean Launchpad methodology. SCV has an insane (~40%) rate of teams starting up through the class. In the Appendix of this post, I’ve shared notes from some memorable SCV lectures.

Wading through the Bay

Stanford is smack-bang in Silicon Valley, with many of the world’s top investors living and working in close proximity. Sand Hill Road and its row of legendary VC offices borders the campus. But all this doesn't mean you're magically integrated into the SF tech/AI scene. It takes effort to get out of the Stanford bubble, and I’ve spent lesser time than I expected off-campus. The Stanford credential is not a magic wand. People here care about what you’re building, not where you studied. I like that.

Inaugural Stanford vs. UC Berkeley robot boxing match in a SF hacker tower

The legendary Halloween celebrations at Steve Jobs’ house in Palo Alto. Steve Jobs sparked a craze that lasts until today wherein tech billionaires compete to put on the grandest show.

Classmates have bumped into Jensen Huang at hotpot. Tim Cook supposedly hikes the Stanford Dish. Sundar Pichai is rumored to frequent the Mountain View Idly Express. I’ve been told that a great way to get a tech job is to hang out at desi restaurants in Sunnyvale and introduce yourself to Indian uncles.

The natural beauty within easy access of Palo Alto, like Muir Woods or Yosemite, is sublime. However, without a car, it’s practically impossible to access any of it. Much like riding a bike on campus, owning a car in California changes the experience entirely.

What’s Farm life like?

Walk through the Stanford campus and you might think you’re at a sun-kissed country club: beach chairs, volleyball, golf carts, and fountains. When I visited campus during Admit Weekend, I asked one of the MBA students, “Shouldn’t everyone be working more?” (he jokingly introduced me as “the guy who hates fun”).

But don’t be mistaken: Stanford Duck Syndrome is real. Underneath the halcyonic surface is a relentlessly competitive, tense, and high-achieving environment. Stanford students don’t allow themselves to accept anything less than extraordinary outcomes. I love how just inserting myself in this environment has upped my ambitions and hunger. But it also means I feel guilty about every moment not spent hustling. Over Winter Break it was great to step out of the bubble and touch grass (and not the manicured Stanford lawns).

The GSB is very un-corporate with a decidedly informal vibe. If you dress/act too preppy, you might get poked fun at. Because the GSB community is so small, it feels intimate. Everyone knows your business. This is a double-edged sword; it’s tight-knit, but it can get gossip-y in a way that feels suspiciously like high school. Reputations are the local currency here. Once you’re identified for the “wrong reasons,” it’s a difficult label to shake.

All the MBA stereotypes about “drinking from a firehose” are true. I thought I was prepared for the intensity of being pulled in ten directions at once, but I had no idea. Opportunity costs are real, and regret is the inevitable tax you pay for choosing one calendar invite over another. Speaking about drinking, as a teetotaler, I had my trepidations about sobriety being a social handicap. It hasn’t been. Whether it’s a generational shift or just the GSB culture, many of my classmates are in favor of small group dinners, hiking, board games, or sports.

The GSB’s culture is student-driven. Unlike other schools that lay out a pre-packaged path, the GSB hands the keys (and the budget) to students and then steps back. It’s often disorganized, but it’s more fun. My favorite week this quarter was traveling to Costa Rica for a Global Study Trip, a student-led and Stanford-subsidized immersive travel experience. The GST was themed on “Sustainability in economic and political transition.” We toured geothermal and hydroelectric powerplants, met with executives from Costa Rica’s largest fruit and dairy companies, and even met a former Presidential candidate. I was floored by my classmates’ nerdiness: everyone was locked in for each meeting, peppering our speakers with more questions than they could handle.

I’ve been blown away by the caliber of GSBers. The people here are treasure troves of stories, experiences, and perspectives to learn from. I feel privileged to be rubbing shoulders with ex-Green Berets, mountaineers, the founder of a humanitarian NGO in a warzone, founders who have successfully sold ventures, even hedge fund traders from the US who know the intricacies of the Indian stock market. Through TALK, a GSB tradition where classmates share their life stories in an extremely vulnerable and confidential space, we really get to dig beneath the surface. I feel privileged to have been admitted to this community for life.

Legend has it that Stanford used to be a more bohemian place, with traditions like the mysterious Game. Nevertheless, one of my enduring memories is Big Game 2026, the annual Stanford vs. UC Berkeley football match. The week-long build-up featured a retelling of the ‘Axe’ history by an elderly Stanford alum. He led us in the Axe yell, based on a chant from Aristophanes’ ancient Greek play, The Frogs:

Give 'em the Axe, the Axe, the Axe! Give 'em the Axe, the Axe, the Axe! Give 'em the Axe, Give 'em the Axe, Give 'em the Axe, WHERE? Right in the neck, the neck, the neck! Right in the neck, the neck, the neck! Right in the neck, Right in the neck, Right in the neck, THERE!

The Axe Committee and the Leland Stanford Junior University Marching Band (LSJUMB) “laid to rest” the enemy on the White Memorial Fountain, with a mock funeral procession. Translation: a cute teddy bear representing Berkeley was decapitated and impaled on the fountain, fluffy innards spilling out, and water was dyed blood red.

Stanford won 31-10, ending a perennial losing streak, and took back the Axe. Absolute bedlam:

A hidden gem I recommend is open-air, trippy audiovisual concerts at the lawn in front of CCRMA (Center for for Computer Research in Music and Acoustics). I attended a CCRMA performance by Molto Ohm which featured a quote on repeat that swirled inside my head: “After all, what could be more shattering, unassimilable, and incomprehensible, in our hyper stressed, constantly disappointing and overstimulated lives, than the sensation of calm joy.”

The farther you venture into Stanford’s hilly outskirts, the quirkier things get, like Enchanted Broccoli Forest (suspended by Stanford administration currently) and other co-ops. Explore Energy House is Stanford's energy-themed undergrad residence. Hundreds of grad students live in Rains, one of Stanford’s largest and oldest residence complexes. Rains throws epic themed parties on Thursdays (like Tear Down this Wall - “an all-out night of spray paint, sledgehammers, and pure destruction”). I live in a studio within Escondido Village, a sprawling complex of 150 buildings between the GSB and Rains. It gives me a good balance of GSB and rest-of-Stanford. In general, GSBers stick to parties within the GSB residences. I wish there was more social cross-pollination.

The Hoover Tower carillon bells belting out Hans Zimmer

Memorial church decorated with diyas for Diwali

Stanford’s artsy Design School - strong IDEO vibes - where I hope to take a class.

Holding a Mirror to Myself

Failures

At the start of Autumn Quarter, I participated in a reflections exercise to rank what’s most important to me. I identified sports as a priority. In practice, I treated fitness as an "unproductive" activity that didn’t carry forward my professional goals. I skipped the climbing wall, running track, and the swimming pool because there was always a "more important" talk or mixer to attend. I failed at "defensive scheduling": the art of protecting non-negotiable time blocks for yourself that we were advised to practice.

I also realized I came in with a narrow mindset: that unless the GSB produced some asymmetric outcome that I couldn't get by staying at work or going to Harvard (HBS had offered me significantly more financial aid), it wouldn't be "worth it." I defined “success” solely as starting a climate-tech venture. Working with an MBA2 Peer Advisor helped me see that I was optimizing every decision just to justify my choice of Stanford. I even skipped traveling with classmates to Utah’s national parks during Fall Break to work on startup ideas (which I didn’t end up doing). I now see not traveling as a regret; the GST showed me that the people and conversations are the most special part. I realized I need to be less instrumental in my relationships and not treat people like networking nodes. I’m trying to be less uptight, more vulnerable, and more intentional about reaching out to people for no reason other than to know them.

I also need to decrease multi-tasking. A professor told us that MBA success rides on being brutally efficient and "present." My mind was usually a whirlwind. I often caught myself checking WhatsApp groups during the very talk I had planned my schedule around. The MBA manufactures a deceptive feeling of busyness all too easily.

Resolutions

I’m learning to make time for things that don't directly contribute to the startup goal. There’s real value in “aimless” activities, and over-engineering the MBA paradoxically leads to less utility. My Personal Leadership Coach helped me realize I have a tendency to prioritize "startup stuff" over everything else, because “this is why I came to Stanford.” I’ve been re-reading and reflecting on a blog by a GSB alum who wrote about “Why I treat(ed) the GSB like a sandbox.”

I’m also coming to terms with defining my own success. Stanford and the Bay Area have a unidimensional definition of success - starting a VC-backed tech company - and while I want to lean into that pressure, I can't force it. I’ll try my best but it still may not work out in these two years. But with a 38% founding rate for GSB alumni, I want to get in reps and leave with the tools and confidence to know I can do it whenever I choose to.

I’m currently navigating two schools of thought regarding what Sajith Pai at Blume Ventures calls ‘The Pick.’ One is the view shared with us by Emily Kirsch at Powerhouse Ventures: that a startup idea needs to come out of deep, lived conviction and domain expertise. The other is Scott Brady’s Research Driven Inspiration, which suggests you can be opportunistic and surface ideas through rigorous customer conversations. Stanford classes like ‘Lean Launchpad’ and ‘Innovation for Climate’ teach this latter methodology. As Sajith writes, it’s important not to "rush the pick" - to look for ideas 5-6 years ahead of the curve rather than what’s hot in the news today. Prior domain experience helps, but its absence can be overcome with domain immersion. I want to leave Stanford being an expert in 2-3 domains and knowing how to get Founder-level smart on any topic.

Beyond that, next Quarter I’ve set the following goals:

Getting into building mode. I’m setting a deadline to actually prototype and market-test a product by taking the class ‘Innovation for Climate.’ I will go through the cycle of idea validation with 100+ customer interviews. I want to "earn" expertise on powering AI data centers and move beyond being a "wantrepreneur."

My Autumn hypothesis about networking with Stanford’s Sustainability Accelerator didn't quite pan out because most Accelerator researchers felt they were "too early" for commercialization activities with an MBA. Next quarter, I will be more intentional about attracting people to me and driving a team forward rather than just trying to attach myself to existing projects opportunistically.

I want to apply and get accepted for Stanford entrepreneurial summer programs like Botha Chan, EcoX, or IDIF, or find a summer internship I’m truly stoked by rather than one for "prestige."

Part of this is also building the confidence to be more contrarian, forming own point of view and depth on a topic and not chasing the hottest/next big thing. Going through the motions of idea validation and forming (or losing) conviction in a business/product will help with this.

Being comfortable with ambiguity about the future and about uncertain outcomes. That also means being more comfortable with the student loan debt I have hanging over my head and despite that burden making more excitement-based rather than fear-based decisions.

Vulnerability and moving away from an ‘instrumental’ mindset regarding the MBA and my classmates. Being less uptight and reaching out to people more intentionally. Doubling down on relationships rather than only going broad with endless coffee chats.

Travel at least once with classmates (even if it’s just a weekend).

Make 2 close friends I can fully be my goofy self with.

Policing my time better with defensive scheduling and not filling my calendar with events. Course-correct when I’m starting to feel busy without accomplishing much. The CEO of Gamma told us at a talk that at the earliest stage of startups “you’ve got to be your own time-cop and set the pace, set deadlines for yourself.” Part of this is also getting back to a good fitness routine. I look up to classmates who opt out of that cool startup talk if it means missing their gym session, or who will stay up till 2AM if it means doing their daily journaling.

I’ve paid $200 for golf lessons knowing that the miser in me will be loath to skip them. Also would be epic to swing clubs where Tiger Woods learned his craft.

Halve the percentage of "useless" events I attend. I want to optimize for events where I either learn something unique or meet truly relevant people.

Processing and reflecting more on my experience by journaling and posting more on LinkedIn / Substack. The experience is lost if learnings come in through one ear and out the other, or if my notes remain enclosed in my notebook.

Spending more time networking with SF climate-tech scene. Make 5+ trips to SF and cold email at least 10 people I look up to career-wise but would never have access to without the stanford.edu email address.

Getting past instant gratification and dopamine hits of controllable, measurable but irrelevant metrics. In other words, study less and not get higher than a ‘Pass’ in any course!

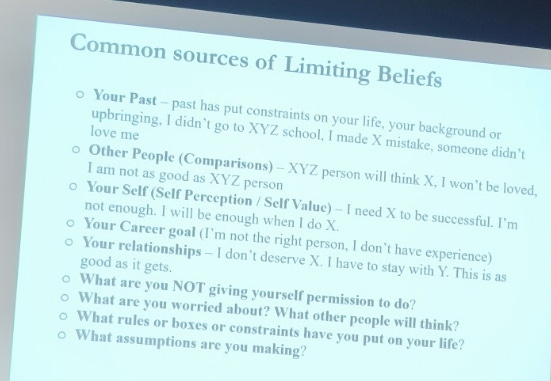

Exorcising Limiting Beliefs

Towards the end of the Quarter, I attended a workshop on “Limiting Beliefs” with Graham Weaver, one of the GSB’s rockstar professors. It left many of us in tears. Graham’s point was that limiting beliefs are self-fulfilling: 75% of our thoughts are negative, and 80% are repeated from the day before. These beliefs reside in our subconscious ‘lizard brain.’ The goal of meditation is to make these beliefs visible so they lose their power.

In silence, Graham made us write down our limiting beliefs:

I grew up in relative comfort and privilege, so I lack the “hunger,” “street smarts” or “killer instinct” an entrepreneur needs.

Stanford won’t be “worth it” compared to the scholarship I turned down at HBS unless I start a climate-tech company - and since the odds are I won’t, I likely made the wrong decision.

I’m not allowed to have “fun” here. The experience can’t ever be frivolous; it has to change my career trajectory dramatically and decisively.

Graham then compounded the pain by asking us to visualize the 20-year consequences of holding onto our limiting beliefs. What would our life look like? What does the limiting belief allow you to do (like be safe, not take risks)? Is holding onto the limiting belief worth the cost?

I’ve committed that the GSB is the last thing I’m doing for the thappa, that heavy stamp of Indian societal approval. GSB asks applicants ‘What Matters Most to You and Why’ and in my essay I wrote about “Authenticity.” Now, it’s time to walk the talk. There are no more generalist “right answers” like consulting or Chief of Staff roles. With multiple safety nets in place, if I don’t shed limiting beliefs and discover what I truly want to do, then when?

The GSB is a ‘Matrix’ where it’s easy to get lost in someone else’s definition of success. There’s a joke that if all of us swapped jobs with each other, we’d be happy. If I can graduate having found a version of success I can live by, it will have been worth it. The answer might be totally different from my current hypothesis.2 But I’m ready to find out.

I’m experiencing pangs of withdrawal after a week immersed in Mexico’s colors, music, and street food. Witnessing 13 humpback whales frolicking in Banderas Bay, I remembered there’s a world beyond AI wrappers.

…but a rainy bike ride chasing a rainbow reminded me that it really doesn’t get much better than right here at the Leland Stanford Junior University, CA.

Appendix - Notes from Stanford lectures and events

I took copious notes from Stanford Climate Ventures and I’m sharing below the lectures I found most fascinating, to give you a flavor of what the class is like:

Breakthrough Energy Ventures’ Climate-tech Outlook

Business-as-usual economic growth gives us 80+ Gigatons CO2e/year by 2055. BEV wants to back companies addressing the ‘0.5Gt/year’ problems that can become Exxon Mobil-scale, worth $5Bn. “We need 10 Teslas by 2050, the Tesla of steel, of cement, etc.” SCV’s instructors told us “be psyched that climate-tech is down, because that means competition is also down.” Spaces BEV is excited about:

Load-following electricity; Low-GHG electricity, seasonal grid storage, transmission, power electronics

Iron & steel

Aviation

Long-distance road transport

Affordable, low-GHG liquid fuels

Cement & concrete

Low-cost, zero GHG hydrogen (like $1/kg)

Ammonia/ethylene

Building: Heating, cooling, insulation. Think of the Sunrun of buildings. Efficiency gets more valuable as energy prices rise.

Agri-methane, rice, soil carbon, afforestation, biodiversity

Shipping (super exciting)

The instructors recommended following these mega-trends (‘where the puck is going’):

AI data center build-out

Compute efficiency

Shifting from fuel-to-material intensive world

Big climate-tech value chains like mining for EV materials

Geoengineering for huge disasters

Cheap space-launch / space-based solar

Adaptation and resilience

1. Software and AI - Emily Kirsch, Powerhouse Ventures

The energy landscape is being rewritten by the power demands of AI. We are seeing a historic acceleration in infrastructure development:

Data Center Growth: There is currently 5GW of data center capacity in operation. However, there is 14GW under construction and a massive 55GW (spread across 193 projects) in the development pipeline.

Utility Directives: Utility leaders are being directed to adopt AI to manage this surge.

The ROI Mandate: In this high-stakes environment, startups must prove ROI first, or clients will quickly turn away.

Several companies are emerging to address specific “white spaces” and friction points in the grid:

Thinklabs: A GE spinout developing an AI “Copilot” to optimize grid decision-making and planning.

Pearl Street: Originally identified a massive “white space” in 2020: interconnection studies. Their software is used to model the U.S. interconnection backlog, which has been a major barrier to connecting new projects to the grid. (Emily referenced Pearl Street multiple times as an exemplar).

Rock Rabbit: Utilizing Large Language Models (LLMs) to automate and extract value from the vast amounts of manual, repeatable data buried in energy industry text and workflows.

Cloverleaf: Focused on delivering fast, clean capacity through software that optimizes compute and data center efficiency.

Guidewheel: Providing software for factories to improve operational efficiency.

Peak Time Solutions: Companies like Tyla, Amperon, and Leap are unlocking capacity during periods of peak demand.

Building a successful energy x AI startup requires a strategic entry point:

The Wedge: Start with “boring” stuff; automate reporting or product ordering. This acts as a wedge into organizations (like Pearl Street did) that isn’t seen as high-risk, allowing you to grow and gain confidence within the org.

Proprietary Datasets: Powerhouse prioritizes companies with proprietary, “non-Googleable” datasets that nobody else has access to. Trust and credibility are the “currency” required to get customers to share this proprietary data in the first place.

The most successful founders aren’t looking for problems to solve. They are living them:

Lived Experience: Powerhouse rarely invests in Founders straight out of college. They want people who have “lived the problem” and know the ins and outs of the language and the investors. They like Founders who have been “hit over the head” by the problem they are solving.

Customer Discovery: A key metric for success is having done 100+ customer interviews before scaling. Founders need to know “what every customer is doing”

Character Diligence: At the pre-seed stage, character diligence is used to evaluate self-awareness and the drive to “show up to everything” and be inquisitive.

In terms of career advice, Emily recommended joining an industry leader and then spinning out as a startup later, like Think Labs did from GE. “If you’re not crystal clear, you might as well get paid to learn”

Hazards: Founders must navigate the “build vs. buy” dilemma for corporations and the high cost/availability of compute for training future GPT releases.

Emily shared that Fortune 500 companies are still looking to “buy” and they pay Powerhouse to find solutions to invest in/utilize.

Market Saturation: While many have piled into carbon accounting, there is massive opportunity in unfashionable sectors where you might have no competition for the first five years.

Powerhouse was actively sourcing startups for process automation for linemen and technicians so they spend less time on reports and more on equipment.

I also attended Powerhouse Ventures’ annual party, New Dawn, in Oakland. Pricey at $80/entry but worth it. I went around introducing myself and asking folks “If you had $10Mn, what company would you start or invest in:”

Managing upstream value chain decarbonization to meet demands of CBAM (EU’s cross-border adjustment mechanism)

Energy marketplaces like Station A

Interconnection with distribution companies

Decentralized data centers powered by renewables

VPPs: Power producer to distributor

An Emerald AI equivalent on data center side

Sodium, solid-state or zinc architecture to make storage cheaper, like Enzinc.

2. Maritime Decarbonization - Brock Mansfield, Meliorate Partners

Ships are fixed assets with very high up-front Capex and 30-40 year lifetimes. Replacing them is going to be challenging.

Fuel is the dominant cost. Most carriers are betting on LNG but nothing reaches price-parity with fossil fuels. Batteries could reach parity in cost but you can’t physically stack enough batteries on a container ship for it to be viable.

Nuclear is hence most exciting but need to bring down cost of SMR (small modular reactors) through innovative design. SMR is a nascent space with no leaders.

Maritime fuels are very nasty with impure outputs. But carbon capture for maritime isn’t as exciting because you need to do something ‘high value’ with the carbon capture.

Practically all ships today are Chinese-made and so maritime’s becoming a US national security issue.

Libby Wayman’s Stanford Energy Seminar lecture on the “race to power AI” and the physical constraints of the grid.

3. Race to Power AI - Libby Wayman, Breakthrough Energy

Wayman, who teaches at MIT and works with Bill Gates at BEV, argues that we have hit a pivotal moment where AI’s thirst for energy is outstripping our ability. For decades, electricity demand in the US was flat. But around 2020, a shift occurred: the growth in compute workload (driven by Transformer models and scaling laws) officially overtook compute efficiency gains. Data centers and AI currently account for about 4.4% to 5% of US electricity consumption. If current growth rates continue, data centers could responsible for 2-3 gigatons of CO2 emissions per year by 2050. Wayman highlighted that we can’t just rely on better algorithms; we need deep “hard-tech” innovations to stop AI from breaking the grid. BEV’s excited about:

Liquid & Immersion Cooling: Moving away from fans to submerging servers in specialized liquids (immersion cooling) can increase power density by 10x and cut energy use by 40%.

Optical Interconnects: Every time data moves through copper wire, it burns energy. Moving optics directly onto the chip (co-packaged optics) can slash power consumption for moving data between compute and memory.

Superconducting Transmission: BEV is even looking at companies using superconductors inside data center buildings to move massive amounts of current with zero losses.

Wayman’s view is that data centers are the “first market” for broader climate technologies. The urgency to power these “gigawatt-scale” sites is forcing the commercialization of firm, zero-carbon power like next-gen geothermal (Fervo Energy, a Stanford spinout) and even fusion (Commonwealth Fusion Systems). What we learn from powering AI today will provide the blueprint for electrifying the rest of the economy, including EVs, by 2035. Wayman ended with a call to action for the “smart minds” in the room. In the “race to just get these things online,” the cleanest approach isn’t always the fastest. For those of us looking to build in climate-tech, the goal is to provide decarbonized solutions that can keep up with the “game on” pace of the AI revolution.

Stanford Climate Week 2025

A highlight of Autumn Quarter was participating in Stanford Climate Week 2025, organized by the outstanding undergraduate Energy Club. They organized a “Green AI Hackathon” sponsored by Microsoft & Google Earth Engine, and divided into two tracks:

Green-in-AI: How can we make AI more sustainable and less resource-intensive

Green-by AI: How can we use AI for Sustainable Development?

I would say these are two of the problem statements attracting most of the climate-interested students at Stanford. Below, I’m sharing my notes from some of the Climate Week talks I attended:

1. ‘Power & Purpose: Corporate Sustainability in the Datacenters Age’

Median Gemini prompt has reduced from 8 to 0.2wh since models improved. Google has its own TPUs. 60% of power use come from chips hence Google is becoming more independent in chip design. Google’s also looking seriously into nuclear and geothermal energy in the US.

Data centers have massive diesel generators and there’s much less focus on sustainability than on ‘how to get any power.’ In Texas, gas-fired generators are back-ordered till 2030.

75% of the US grid is utilized versus China’s 150% utilization. There’s a political arms race going on versus China for AGI and China isn’t prioritizing sustainability as an end in itself. Their grid is much more modern, and if computing comes down to energy, the US needs to catch up fast to be competitive.

There’s competition for grid energy when weather is the hottest and coldest, and we need to design for those ranges when HVAC is especially strained.

Circularity of materials is a huge challenge: re-using chips and re-purposing them for lower-order tasks like inference.

Tech to smooth out grid demand profiles, refrigerants and HVAC design (trying to move to low GWP refrigerants), water use efficiency to increase cycle of circulation inside data centers are increasingly important.

2. ‘Lab to Startup: Deep-Tech Startups in Climate’

You should try to answer the question “How quickly can you disprove your experiment?” The longer you fail to kill what you’re working on, the more successful you will be.

Deep-tech startups are a commitment for the next best 15 years of your life. Do you have a customer you’re obsessed with? It took Fervo 5 years and $500Mn to prove geothermal energy, but Google said they would purchase as much energy as could be produced. You have to love the problem the way Fervo’s founders did in order to make it in deep-tech.

Know your customer intimately. ‘Wind developers’ are not customers. Who is ‘Teresa’ at the wind developer and what are her problems? Teresa is your customer. What’s the ‘secret problem’ in your industry, the non-obvious things that make it tick? With 100+ conversations you can become conversant in the industry, and then people point you to known people. You have to ‘earn’ this secret. Your storytelling ability comes from having had these conversations.

VC’s invest in a timeline: What looks like a bad idea to most right now but is actually a good idea. Terradot (another Stanford climate spinout) started with soil organic carbon before pivoting to ERW. You have to do something nobody else is. There’s a GSB grad who went to work in a flower factory. Don’t follow the herd.

3. ‘Carbon Removal Panel’

Featured Boomitra and Terradot (both Stanford founders):

In CDR, the key concept is ‘project finance market fit.’ Are there people willing to fund your project at-scale?

Boomitra has a ‘carbon-hacking team’ to find the ‘next big ton CO2e’ because soil organic carbon capture plateaus.

Boomitra’s CEO is moving to Singapore or Tokyo because of how important the Paris Agreement’s Article 6 is becoming. The shift from voluntary to compliance markets is picking up place rapidly.

Integrity remains the key issue for carbon markets. Exxon Mobil and ADNOC have endorsed a new coalition to standardize MRV.

I asked Terradot and Boomitra what are their respective moats, as pathways like biochar and ERW become increasingly commoditized. For Boomitra, it’s their brand. For Terradot, it’s being conservative and rigorous with science early-on; doing more soil tests than required. IP may not be a long-term moat since eventually MRV will become open-source.

4. ‘Inside Google’s AI for Energy Accelerator’

Featured Savannah Goodman, Head of Advanced Energy Labs at Google, and Julia Wu (Spark AI) and Dhruv Suri (Pravah), founders in the accelerator

Dhruv shared how he approached Indian utilities to pitch digital twins of the grid. However, they didn’t even know where their poles and wires were located! So Pravah started with a street vision solution.

The Tapestry team at Google (who Dhruv worked with briefly) were trying to build customized grid solutions for each country, but Dhruv felt that’s not scalable. The vision for Pravah is a global SaaS platform for utilities.

Pilots are easy to land, but ‘death by pilot’ is very real for climate-tech startups. Go into pilots with specific outcomes and outperform them.

Spark’s version 1 is already out-of-date. Users in energy like consistency and citations, so Spark needs to keep up with search LLM’s. Modularity - being able to swap models quickly - has become very important. Julia is always playing around with the ‘next coolest coding agent’ and trying out new models against the data to see if any model works better. Sometimes older models are actually more consistent.

The moat for AI startups according to Julia is curation of data that isn’t ‘Google-able.’ Spark gives credit ratings for feasibility and wants to replace expensive reports by local experts. Julia worked very hard to get the first 1-2 contracts and would do a lot of things manually to delivery reports, which also helped her understand where customers’ skepticism comes from.

Autocrats vs. Democrats: China, Russia, America, and the New Global Disorder - Talk by Michael McFaul (former US Ambassador to Russia)

Ambassador McFaul explored how the world moved from a period of democratic triumph following the 1991 collapse of the Soviet Union to today’s state of confrontation. He identifies three primary drivers behind this shift:

Power Dynamics: China and Russia are significantly more powerful today than they were 30 years ago, while the U.S. is relatively weaker compared to them.

Regime Types: There has been a 20-year decline in global democracy, with China and Russia becoming more autocratic and the U.S. facing its own democratic challenges.

Individual Leaders: The specific worldviews and decisions of leaders like Putin, Xi Jinping, and President Trump have played a direct causal role in changing international relations.

McFaul argues that today’s disorder is both similar to and fundamentally different from the Cold War.

Similarities

Superpower Competition: The world remains defined by nuclear superpowers and large conventional armies.

Ideological Clashes: There is a clear and ongoing ideological fight between autocracies and the liberal democratic West.

Duration: McFaul predicts this competition will last for decades, much like the original Cold War.

Key Differences

Economic Interdependence: Unlike the Soviet era, the Chinese economy is highly intertwined with both the American and global economies.

Internal Ideological Drama: During the Cold War, the struggle was primarily between states. Today, it is also within states, as illiberal, populist-nationalist values gain traction inside Western democracies.

Nature of the Chinese Threat: China is not currently viewed as an “existential” threat seeking to “wipe the U.S. off the face of the earth,” but rather a long-term competitor seeking influence within international system.

McFaul assigns the current U.S. approach a “B minus” grade, highlighting several strategic concerns:

The Danger of Isolationism: He warns that alienating allies and withdrawing from multilateralism (such as the Trans-Pacific Partnership) erodes the strength of the free world.

Soft Power Disarmament: While China invests in global influence through initiatives like the “Belt and Road,” the U.S. is dismantling its own soft power instruments like USAID and international broadcasting.

Successes to Replicate: The U.S. should lean into its historical strengths: building alliances, fostering a strong economy, and attracting the “best and brightest” through immigration.

Despite the current “disorder,” McFaul maintains that it is too early to bet against the free world:

Combined Strength: The democratic world still possesses superior military and economic power, holding nine of the ten largest economies globally.

Prosperity: The richest and most capable countries remain those that are most democratic.

Human Aspiration: Majority opinion around the world consistently favors electing leaders over living under autocratic or theocratic regimes.

Inspiration from the Frontlines: McFaul points to leaders like President Zelensky as proof that the normative power of democratic ideas remains a formidable force against autocracy.

The course instructor has made all the assignments publicly available; they are intended to take you from noob to expert in how to use AI to improve your software engineering productivity.

Thank you for taking the time to honestly reflect on your experiences! This is so valuable.

hi gauraang! as I digest all the tiny pieces of insights from this, I do want to highlight and appreciate how “to go beyond prestige and actually do things you’re stoked about” resonates. hoping to be brave enough in face of all the choices to make the right one. what a great read. thank you for sharing!